Published by Apha-Sense – WilliamFreedman-Alpha-Sence (link to this poosting: https://bit.ly/3hrI2SZ)

As Janet Yellen famously noted, economic expansions don’t die of old age. She said that when the post-Great Recession boom was a mere stripling of six years and its best times were yet to come. It lived another four-plus years—and it still didn’t die a natural death.

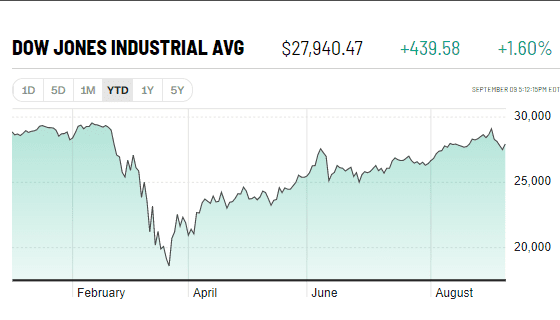

Today, although the stock market is still in the denial stage of grief, it’s not certain that the economy will rise from the grave. What’s more likely is that a lot of money in the long-equity portfolios of self-deluded investors will become topsoil shoveled onto the casket. There might not be a crash per se, but the trend for the second half of 2020 will not be a happy one. Keep the Kleenex handy.

Takeaways

Despite appearances, this is not a bull market; it’s more likely a bear market-in-waiting

Covid-19 will probably continue to dominate news and exacerbate the recession through end-of-year

Homebuilders should thrive at the expense of commercial real estate developers

The Biotechnology, Software and Metals & Mining industries should fare best in the second half, as should carefully selected Emerging Markets shares

Post mortem on H1

As of this writing, the first half of 2020 isn’t quite over, but close enough. Here’s where the market stands: The S&P 500 index is down 4.55% since January 1. That’s pretty good considering that, on March 23, it had dropped more than 30% year-to-date.

No surprise here, but the hardest hit sector was Energy. Remember those headlines from when the price for a barrel of oil was a -$40? That was a glitch in the commodity trading system but, even at the current +$40 per barrel, that’s still less than the cost to find it, drill it, pump it and sell it. As a result, energy is down 37.04% year-to-date.

Considering how well stocks have rebounded since the initial coronavirus panic, it’s odd that the financial sector is down 23.18% since January 1. Indeed, the Capital Markets industry is in a modest 4.23% year-to-date slump – a mirror image of the S&P. But the retail end of the sector – the Banks and Consumer Finance industries – each lost about one-third of their value.

While Industrials, Real Estate, and Utilities all saw double-digit drops, the Information Technology sector was unique in reaping a double-digit gain. Overall, it was up 13.11% year-to-date, almost all of it due to software and hardware sales; services, network gear, and computer parts all had lackluster first-half returns.

But if you’re looking for the one, singularly successful industry during the COVID-19 crisis, it was in none of those industries. It was the Internet & Direct Marketing Retail end of the Consumer Discretionary industry, which advanced 40.74% year-to-date. Airlines, tucked into the Industrials sector, was the worst-performing, plummeting 50.12%.

Sure, this could all change quickly, but there’s little reason to take that on faith. A Moving Average Convergence/Divergence oscillator shows that the 12-day average for the S&P has been steadily below the 26-day for weeks, suggesting that sentiment is bearish, no matter how frothy the stock market recovery appears on its surface.

With the familiar caveat that past performance is no guarantee of future results and that everything else in this forecast consists of forward-looking statements, let’s see what the future might hold through the end of The Worst Year Ever.

H2 outlook: Communication Services

Communication Services might actually be a ray of sunshine on the stormy horizon. The 5G rollout has been delayed, but it hasn’t been abandoned. And if we’re all going to be working and studying remotely, it’s going to become increasingly critical to the economy.

And that economy is likely to be far more inclusive, following the nation’s sudden realization that the so-called “digital divide” between rich and poor is significant. Money will almost certainly be spent to bring 5G to the inner city. Whether it’s coming from the public sector or from brand builders in the private sector, resources could soon be brought to bear. Then just as once-impoverished countries leapfrogged past landline telephones and went straight to the Galaxy S7 Edge, some of America’s most neglected neighborhoods might have the fastest upload speeds a year from now.

T-Mobile US (TMUS: $110.19) might be well-suited to take advantage of this surge, but a lot of this thesis is already priced in.

H2 outlook: Consumer Discretionary

In good times and bad, how you feel about the Consumer Discretionary sector reflects how you think about the broader economy. Since we have no tangible idea of how we’re going to recover in the second half, let’s remember that the score at the end of the first half is COVID 19, Humanity 0.

This analysis is being written on a day when the U.S. set a 24-hour record for new infections.

So, as this second peak – oh, we’re not even talking about the second wave – skulks around the country, you can expect Internet & Direct Marketing Retail to continue to thrive, and Automobiles to continue to tank.

While the news is already factored into those industries’ share prices, here’s one thought. This is the sector that contains homebuilders, and there is a persistent housing shortage in this country. As the real estate sector, as a whole, struggles while it figures out how to switch gears from erecting gleaming office buildings and hotels to crafting private living space PulteGroup (PHM: $32.58) has been attracting attention.

H2 outlook: Consumer Staples

Quarantine has gotten to us all. While the Tobacco industry contends with its secular decline, it’s telling that another Consumer Staples industry, Personal Products, has also been in the doldrums to much the same degree since the lockdown began. You know. Cosmetics. Shampoo. Deodorant.

If you’re looking for relative bright spots, consider such countercyclical names as the currently dipping Colgate-Palmolive (CL: $72.64) under Household Products, or Kroger (KR: $32.78) in Food & Staples Retailing.

H2 outlook: Energy

Just, no.

H2 outlook: Financials

Nothing to see here either. If every other Financials industry is down double-digits year-to-date, why is Capital Markets treading water? It can only be that securities prices are untethered to what the retail banks, credit card issuers, business lenders, and insurers are seeing.

And that’s not just because these are weird times. If there’s anything well and truly scary about the second-half outlook, it’s this: Over the past three years, Financials as a sector is down 1%, but Capital Markets is up 20%. There’s a reckoning coming; it’s just a question of when.

H2 outlook: Health Care

The bifurcation in this sector is between research-and-development and delivery. Delivery is in an uncertain place right now, both in terms of how health care is provided – we were all laughing at the concept of “telemedicine” six months ago – and how it is paid for. That latter issue is entirely a political decision, and we won’t know who’ll be making those until January 20, 2021, if then. As it turns out, maybe we didn’t need all those doctor visits in the first place. The Kaiser Family Foundation reports that almost half of those surveyed skipped or postponed medical care during the pandemic, and only 11% of them say their condition got worse. So maybe that’s not the end of the business where you want to place your chips now, despite its countercyclical history.

R&D is still a growth area. Biotechnology and, to a lesser extent, Life Sciences Tools & Services continue to surge, spurred in no small part by the race for coronavirus vaccines and treatments. Biogen (BIIB: $260.30) took a hit from an adverse court ruling recently, so it looks a little less pricey than its peers.

H2 outlook: Industrials

If you’re a well-disciplined contrarian or just a cockeyed optimist, sure, there are bargains to be found here. But generally speaking, this is a capital-intensive sector, and nobody’s going to be throwing money at it until Consumer Discretionary turns around.

There’s one exception: the Professional Services industry. It’s not doing much better than anyone else, but it’s efficient in terms of return on assets. While it’s hard to pick a winner, Nielsen Holdings (NLSN: $13.91) might have fallen as far as it’s ever going to. NLSN is unprofitable, swimming in debt, and likely to eliminate its dividend–but that is already baked into the price. Some smart people have placed bets on its turnaround.

H2 outlook: Information Technology

The hot industry in this sector is Software, which is further divided into System Software and Application Software. The big breakout in the system end is ServiceNow (NOW: $396.37), but that ship looks to have sailed. On the application side, the same could be said for Salesforce (CRM: $185.10). The rest seem to be moving in synch. The few laggards all have good reason to be tanking. Tech doesn’t generally flourish in recessions anyway.

H2 outlook: Materials

The only sign of life among the basics is in the Metals & Mining industry. Newmont (NEM: $58.86) has led the charge, and a lot of people missed out on that one. Bringing up the rear, though, is Freeport-McMoRan (FCX: $10.92).

H2 outlook: Real Estate

This sector zooms in on the highly cyclical commercial real estate – offices, hotels, luxury apartments – and ignores residential. There was too much office space even before we were ordered to avoid it. Once these REITS and developers figure out that the near future is in homebuilding – which is covered under Consumer Discretionary for no good reason – then it will be time to take another look here.

H2 outlook: Utilities

Recessions are usually good for these “granny” stocks, but not this time. The sector is slumping versus the itself-slumping broader market, all except for the Independent Power and Renewable Electricity Producers industry. That’s cratering. Ignore everything everyone is saying about “impact investing,” “sustainability,” or “ESG.” At this moment, few are betting on green technology.

Any better ideas?

These prognostications are based on a number of assumptions. Mainly, the coronavirus is still with us, there will be a second wave, much of the country is mishandling the first wave, and the pandemic is going to get worse before it gets better very late in the year. The economic fallout from this thesis is that we’re not going to have a V-shaped recovery. It was in our grasp, but we bobbled it. This recession – all right, maybe a very mild proto-recovery – will extend through the fourth quarter.

While it’s possible that Europe, Japan, or South Korea could emerge more expeditiously than the U.S., so far their benchmark indexes seem to be moving in concert with the S&P. So we turn to the developing world, where equities have retreated in both dollar and local-currency terms.

China appears to be first in, first out of the pandemic and is starting to grow, and online retailer JD.com (JD: $59.52) is attracting a lot of attention. Even so, you can’t ignore the political kerfuffle between Washington and Beijing. India-based outsourcer HCL Technologies (HCLTECH-IN: $12.35) appears to be thriving in a difficult environment.

South America, meantime, is responding to the pandemic even worse than the States. And that’s saying something.

William Freedman, MBA, writes about finance and technology. He serves on the board of governors of the New York Financial Writers’ Association.

Other sources: https://money.cnn.com/data/markets/dow/